Content:

Features of the banking system of Ukraine

- How do Ukrainian banks work?

Rating of banks in Ukraine: a review of institutions with the best service conditions

- Privatbank

- Monobank (from Universalbank)

- Oschadbank

- Raiffeisen Bank

- Ukrsibbank

Operations with a Ukrainian bank account: what you need to know

- Account opening

- Account transactions and service selection

Conclusion

Frequently asked Questions

- Is it possible to open an account online in a bank of Ukraine?

- What documents are required to open an account in Ukraine?

- Is it possible to open a bank account in Ukraine without documents?

Sources

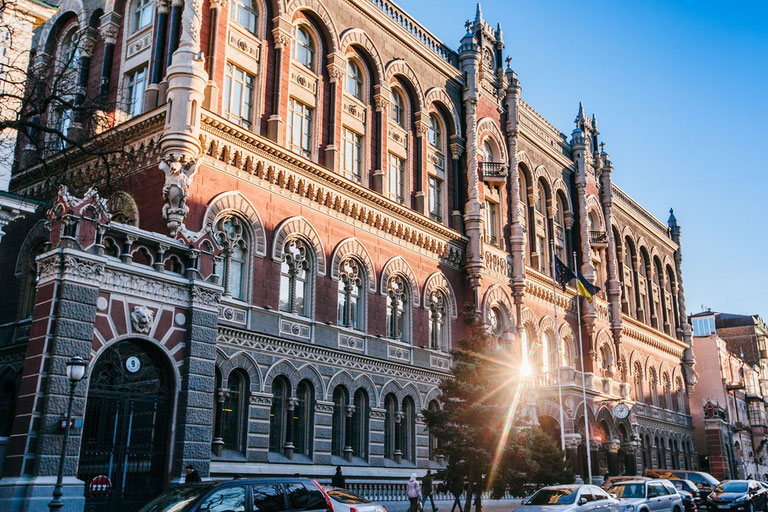

Features of the banking system of Ukraine

Contrary to popular belief that Ukraine is an agrarian country and does not have developed technologies, it was here that for the first time digital passports were equated with their paper, printed version. In addition, cryptocurrencies were also recently legalized here, and the country itself became the first in the world in terms of the number of cryptocurrency holders (every fourth Ukrainian owns digital assets).

Banks of Ukraine operate at a fairly high level: ATMs are found at every step, almost all transactions can be performed online, and payments can be instant (within Ukraine). The banking system of Ukraine is two-tier, and in total there are 69 banking institutions in the country, including:

- 31 banks with foreign capital;

- 5 public financial institutions.

A license is issued to banks by the National Bank of Ukraine, which controls their activities, monitors compliance with the law, and also dictates the working conditions by setting the discount rate. Each bank is a member of the Deposit Guarantee Fund for Individuals, which protects the savings of bank customers and guarantees the return of funds in the event of bankruptcy or insolvency of the institution.

How do Ukrainian banks work?

The official currency of the country is the Ukrainian hryvnia: as of July 20, 100 hryvnias are equal to 185 rubles, 3.38 dollars and 3.30 euros. You can meet coins of 10, 25, 50 kopecks and 1, 2, 5 and 10 hryvnias, as well as banknotes of 20, 50, 100, 200, 500 and 1000 hryvnias. Other currencies are also common in the country - dollars, euros, the pound sterling, the zloty and others, they can be easily exchanged at an exchange office or a bank branch.

The functioning of the country's banks does not differ much from the work of institutions in other states: ATMs in Ukraine are quite common, the use of cards is often in resort areas, and loans and deposits are available to almost all citizens.

The working hours of banks in Ukraine do not differ much from the working conditions of banks in other countries of the former CIS: the work of branches starts at 08:00–09:00 and ends at 17:00–18:00. Branches are open from Monday to Friday, there is also a lunch break between 12:00 and 14:00 lasting 1 hour. Technical support services, ATMs in Ukraine and terminals work around the clock.

There are no dollar ATMs in Ukraine: when withdrawing cash, the bank converts the funds into hryvnia and issues the required amount. You can get dollars in cash by contacting an exchange office or bank cash desk, as well as using online services. The commission at ATMs in Ukraine depends on the conditions of the bank and often amounts to 1-3% for withdrawals. Citizens of Ukraine who have a bank account can withdraw funds without commissions using payment cards (debit card).

Rating of banks in Ukraine: review of institutions with the best service conditions

GEOLN.COM compiled the TOP banks of Ukraine with 5 places, which included the largest banks in Ukraine, as well as the most famous and reliable institutions. This rating of banks in Ukraine will help you determine the best bank, as well as decide which Ukrainian bank to choose.

According to the stability rating of Ukrainian banks for the 1st quarter of 2022, compiled by the Ministry of Finance, the TOP-10 banks include:

- Raiffeisen Bank (Raiffeisen Bank, Austria);

- OTP Bank (OTP Bank, Hungary);

- Ukrsibbank (BNP Paribas Group, France);

- Credit Agricole Bank (Credit Agricole, France);

- Kredobank (PKO Bank Polska, Poland);

- Privatbank (state bank);

- Ukreximbank (state bank);

- Oschadbank (state bank);

- Universal Bank (Ukraine);

- Pravex Bank (Intesa Sanpaolo, Italy).

At the same time, our rating takes into account not only the financial performance of banks, but also their availability, service level and pricing policy.

1. Privatbank

When mentioning banks in Ukraine, the first thing that comes to mind is Privatbank, formerly a private, but now a state-owned bank, which is in demand among the majority of the country's population. Privatbank ranks 1st in Ukraine in terms of the number of deposits of individuals, loans issued to individuals and legal entities, as well as in terms of profit for the 1st quarter of 2022. The Bank offers the following terms of service: Deposits and contributions - up to 6% per annum;

Loans - 18% per annum for cash loans, 12-16% per annum for mortgages;

Credit cards - up to 55 days of grace period, limit up to UAH 200,000; Sending funds abroad - $1-50 transfer fee;

Sending funds within Ukraine - 0% between Privatbank cards, up to 2% of the amount to a card of another bank.

Privatbank is popular among users due to convenient and secure mobile banking, the availability of branches and ATMs in the country, as well as the profitability of the services provided.

2. Monobank (from Universalbank)

Reliable banks in Ukraine include Monobank, the country's first online bank without branches. The bank made a splash with a completely new approach to communicating with customers (memes, jokes, using images of cute cats), as well as providing services by completely moving to the Internet and popular social networks (Telegram for communication with technical support, for example). The terms of service here are as follows:

- Deposits and deposits - up to 8% per annum;

- Loans - 3.1% per month for cards, 21-147% per annum for other loans;

- Credit cards — up to 62 days grace period, limit up to UAH 100,000, cashback up to 20%;

- Sending funds abroad - $1.5-$50 transfer fee;

- Sending funds within Ukraine - 0% between Monobank cards, 1.8% of the amount to a card of another bank.

Clients choose Monobank due to the availability of the cashback option (returning part of the amount from the purchase with real money, not bonuses), the ability to transfer funds to a nearby person by shaking the smartphone (Shake to pay) and unique opportunities for FLP (a separate login for an accountant, free account creation and cash withdrawals, etc.). Being not the largest and most profitable in the country, Monobank remains one of the leaders in terms of the number of clients in Ukraine. The main disadvantage of the bank is that only customers who have a smartphone based on IOS or Android can open an account.

3. Oschadbank

Comparison of Ukrainian banks is not complete without Oschadbank, the state-owned bank with the largest number of branches in the country. The bank is in second place in the country in terms of profitability and assets. Mobile banking is also available, but its functionality is limited - for example, you cannot transfer money to a card by scanning a QR code. The Bank offers its clients the following conditions:

- Deposits and contributions - up to 10.5% per annum;

- Loans - 3.9% per month for cards, 56-91% per annum for a cash loan, 7-16% for a mortgage;

- Credit cards - up to 62 days grace period, limit up to UAH 250,000;

- Sending funds abroad - $15-500 fee for SWIFT transfer;

- Sending funds within Ukraine - 0% between Oschadbank cards, 1.8% of the amount to a card of another bank.

Oschadbank, in contrast to the Privatbank and Monobank mentioned above, has concluded an agreement with the state for the issuance of pensions to pensioners, and therefore assistance can be obtained not only at the post office, but also at a bank branch. In addition, Oschadbank also provides services for obtaining a subsidy for a communal apartment. The bank is most in demand among those wishing to open salary or deposit cards.

4. Raiffeisen Bank

Ukraine's stable banks include Raiffeisen Bank, a network of banks of Austrian origin. The institution is the largest bank in Ukraine with foreign capital. It also ranks first in the 2022 bank sustainability rankings. A bank card with free withdrawals and deposits has gained popularity (other institutions cannot offer it). Consider the conditions offered by the company:

- Deposits and contributions - up to 8.5% per annum;

- Loans - 4% per month for cards, 32% per annum for a cash loan;

- Credit cards - up to 100 days grace period, limit up to UAH 250,000;

- Sending funds abroad - $15-50 SWIFT fee;

- Sending funds within Ukraine — 0% between Raiffeisen Bank cards, 1.5% of the amount to another bank card.

Raiffeisen Bank cooperates with many partners, and therefore offers unique cards, such as Visa Fishka for accumulating points, an ATB card with a 5% discount on goods in the ATB chain of stores, and others. Clients trust the bank, and therefore actively open deposits in it and use loans at a relatively low rate.

5. Ukrsibbank

The only financial institution in the country with an AAA rating closes our TOP-5 Ukrsibbank (or Ukrsibbank). This bank offers the largest number of premium cards and service packages, and also provides an investment opportunity. Deposit rates are the lowest here, thanks to which Ukrsibbank also keeps loan rates at the lowest level. The terms of service here are as follows:

- Deposits and deposits - up to 0.5% per annum;

- Loans - 3.75% per month for cards, from 49.98% to 108.71% per annum for a cash loan;

- Credit cards - up to 56 days of grace period, limit up to UAH 200,000;

- Sending funds abroad - $50 commission for transfer via SWIFT;

- Sending funds within Ukraine — 1%+5 UAH between Ukrsibbank cards or cards of other banks.

Ukrsibbank ranks seventh in the country in terms of its assets, and the percentage of its problem loans is only 2.5%. Customers love the bank for its service, breadth of offer and favorable terms of cooperation.

Operations with the accounts in the Ukrainian bank: what you need to know

The principle of operation of banks in Ukraine has much in common with the organization of banks in the countries of the former CIS, but there is still a difference: it lies in the functioning of institutions, their rules and requirements. Consider and learn how to work with banks in a given country.

Opening an account

In which bank of Ukraine is it better to open an account?

When wondering which bank to choose in Ukraine, you should first pay attention to the list of the most reliable and stable banks according to the resource of the Ministry of Finance (for the 1st quarter of 2022):

- Raiffeisen Bank (Raiffeisen Bank, Austria);

- OTP Bank (OTP Bank, Hungary);

- Ukrsibbank (BNP Paribas Group, France);

- Credit Agricole Bank (Credit Agricole, France);

- Kredobank (PKO Bank Polska, Poland);

- Privatbank (state bank);

- Ukreximbank (state bank);

- Oschadbank (state bank);

- Universal Bank (Ukraine);

- Pravex Bank (Intesa Sanpaolo, Italy).

In addition, the TOP-5 on GEOLN.COM, which includes Privatbank, Monobank, Oschadbank, Raiffeisen Bank and Ukrsibbank, will also help in choosing. The rating is based on the popularity, reliability and profitability of banks for the client.

Evaluate the conditions of each of the banks and choose the most attractive option for you, and the question in which bank of Ukraine to open an account will disappear by itself.

In which bank of Ukraine is it better to open a card?

Every bank in the country offers customers both debit and credit cards with different terms and conditions. Compare offers and choose the most suitable card for you. The cards of Privatbank, Monobank and Oschadbank are in the greatest demand.

Account transactions and choice of services

Which card to open in Ukraine?

Before opening a card at a bank, decide on the purposes for which you want to create a bank account. The list of the most common goals and preferences of clients looks like this:

- Obtaining a loan for real estate / car / other purposes;

- Saving and increasing funds by opening a deposit;

- Operations through the bank (transfers, payments, charity).

Determine what is the most important item for you, and then sort the offers of banks according to their profitability. For example, credit cards with cashback and a grace period are great for getting a loan, and debit cards with interest-free cash withdrawals are great for payroll.

In addition, banks also offer premium cards that provide access to airport waiting areas, concierge service, discounts on services and goods, and much more. Familiarize yourself with the offers of banks and choose the most attractive of them.

How to put money on a card in Ukraine?

Having opened a card or an account, the question arises: how to deposit money into an account in Ukraine? The development of the banking system allows you to replenish the card in just a few minutes. There are several ways to do this:

- Top up your account through a terminal or ATM-terminal of any bank (ideally, through the terminal of the card-issuing bank with a minimum commission);

- Transfer money from another card or account to a new card;

- Ask people you know to send you funds in exchange for cash;

- Use Payoneer, PayPal, EasyPay, TransferGo and others to fund your account;

- Use IBOX terminals to replenish your card or account;

- Contact the cashier of any bank to send funds to the account.

Conclusion

The banking system of Ukraine is recognized as one of the most developed and modern systems in the world: there is mobile banking, banks without branches, and ATMs at every turn. When choosing a bank to open an account, it is worth considering not only its popularity, but also its reliability and stability. Today we have compiled the TOP-5 banks of Ukraine, which included Privatbank, Monobank, Oschadbank, Raiffeisen Bank and Ukrsibbank. We hope our rating helped you make your choice and compare offers from different banks!

Frequently Asked Questions

Can I open an account online with a Ukrainian bank?

Yes, most financial institutions provide the opportunity to open an account without a personal visit to a bank branch. To do this, you will need to provide a scan or photo of your passport, TIN (in Ukraine - RNOKPP) and a photo of a person with an open document in their hands.

What documents are required to open an account in Ukraine?

Non-residents of the country can create a bank account by providing the following documents:

- Original international passport;

- A document confirming the place of residence / stay of a foreigner;

- A document confirming the solvency of the client (optional, for example, income statement);

- TIN obtained from the Ukrainian tax office;

- Work permit / residence permit.

Please note that in order to open an account, you must be legally in the country: if your visa is overdue, you will not be able to get a bank card.

For citizens of the country, it is enough to provide a passport and TIN, as well as take a photo with documents to open an account.

Is it possible to open a bank account in Ukraine without documents?

You cannot open an account without providing documents. To successfully create an account or card in a bank, you need to provide all the documents that are listed in the bank's list. In some cases (for example, to increase the credit limit), you can additionally bring other documents to get more favorable conditions from the bank.

Sources :

- https://opentv.media/ukraina-pervaya-v-mire-po-kolichestvu-vladeltsev-kriptovalyuty-rejting-triple-a

- https://www.fg.gov.ua/articles/19-koshti-shcho-garantuyutsya-fondom.html

- https://minfin.com.ua/banks/rating/

- https://forinsurer.com/rating-banks

- https://privatbank.ua/

- https://pravdop.com/publications/praktiki-kompanii/otkritie-scheta-v-banke-dlya-inostranca-v-ukraine-07-2020-108/

- https://my.ukrsibbank.com/ru/personal/

- https://www.monobank.ua/

- https://www.oschadbank.ua/

- https://my.ukrsibbank.com/ru/personal/