Foreign real estate is a dream of many Europeans, including Ukrainians. Affordability, simplified visa regime for travel and stay, employment and study opportunities, benefits of obtaining a residence permit for yourself and your family members, climate appeal, often lack of language barrier and hospitality of nations - all these arguments explain the incredible demand for real estate from outside foreigners in Ukraine, Turkey, Poland, Georgia, Spain and other European countries.

According to unofficial statistics, over the past few years foreigners have purchased: more than 15,000 apartments in Poland, with 17% of buyers being Ukrainian, 27% from Germany and 13% from the UK.

In Spain, foreigners purchased more than 13.4% real estate in the last year and the number of transactions exceeded 50,000 per year, which, according to the General Board of Notaries, makes up 19.4% of all sales. The largest number of real estate in Spain was acquired by the British (13.9%), French (8.8%), Germans (8.2%), Italians (7.7%),%), Romanians (6.9%) and Belgians (6.2%), representing a total of over 51.2% of all real estate transactions.

In Georgia, the figure for real estate transactions where a new owner becomes a foreigner is over 25,000 transactions per year.

Real estate off the coast of Turkey is also in good demand. For example, in 2019, foreign nationals purchased more than 24,000 apartments in different regions of Turkey. In the first-place buyers from Iraq, followed by citizens of Iran, Kuwait, Saudi Arabia and the Russian Federation. Europe's investors are also attracted to the Turkish real estate market, as more than 900 UK residential properties have been acquired by European citizens in 2019. Ukrainians take 19th place in the ranking buyers of Turkish real estate and buy an average of 50-60 apartments in Turkey every month.

Let us analyze briefly the main requirements for a contract of sale and purchase of real estate with a foreign counterpart on the example of the legislation of Ukraine, Georgia, Poland, Spain and Turkey and the advantages of such property.

Ukraine

Ukraine. According to Art. 13 of the Law of Ukraine "On the Legal Status of Foreigners and Stateless Persons" of September 22, 2011 No. 3773-VI - foreigners and stateless persons may own any property, inherit and bequeath it, as well as have personal non-property rights. Therefore, foreigners can acquire real estate by entering into a real estate purchase and sale agreement in the manner prescribed by applicable law. According to Art. 657 of the Civil Code of Ukraine the contract of sale and purchase of a house or apartment, as well as other real estate, is concluded in writing and is subject to notarization and state registration.

Important conditions of concluding a contract of sale and purchase of real estate by foreigners in Ukraine are: legal stay on the territory of Ukraine; the presence of an individual's identification number; presence of an open bank account for settlement in the contract of purchase and sale of real estate in national currency. It should be noted here that most often the non-resident account to which the money is to be transferred is opened with a foreign bank. In this case, the buyer will have to pay in foreign currency in compliance with the requirements of the legislation on payments in foreign currency. Also, it should be kept in mind that in accordance with the Law of Ukraine "On Currency and Currency Transactions" of 21.06.2018 № 2473-VIII, an individual may import into Ukraine and export cash and precious metals outside the Ukraine in the amount / value not exceeding EUR 10,000 equivalent, without written declaration from the customs authority. However, if the amount of cash and bank metals is equal to or exceeds EUR 10,000, written declaration to the customs authority in full is required.

You will also have to pay real estate taxes: if the property is owned by the seller for less than 3 years, then it is necessary to pay 1% - pension fund (withheld from the buyer), 1% - state duty (withheld from the seller), 18% - tax on personal income (PIT), which individuals pay according to the results of the official annual declaration (withheld from the seller), 1.5% - military fee (withheld from the seller).

Advantages that a foreigner gets when buying real estate in Ukraine. First of all it should be noted in many countries of the world there are laws that entitle those who have purchased real estate to obtain citizenship or a permanent residence permit under the simplified procedure. In Ukraine, this possibility exists only indirectly. The point is that immigration permits are issued to those people who have invested more than $ 100,000 in the Ukrainian economy. By itself, the purchase of real estate is not considered an investment, and therefore the legislation of Ukraine does not provide for the possibility of issuing a temporary residence permit to foreigners who own the real estate.

Poland

Poland. Polish law distinguishes between two types of real estate: an apartment and a house. Foreign nationals have the right, in accordance with the national legislation of Poland, to freely acquire ownership of apartments, that is, separate living quarters in an apartment building. No special permission or status is required to make such an agreement.

However, if the foreigner intends to become the owner of a house with a plot of land or real estate in the border area, or a plot of land of more than 1 hectare, then the permission of the Ministry of Internal Affairs of Poland, which is issued by written application, will be necessary. The permit procedure usually takes 2 to 4 months. At the same time, a foreigner may be refused permission to buy real estate if: the foreigner has not proved his connection with Poland; the real estate mentioned in the statement threatens defense, state security and / or public order; the purchase of the real estate mentioned in the statement would be contrary to the considerations of social policy and public health. The issued permit is valid for two years from the date of issue and allows you to buy the specified real estate according to generally accepted rules. Buying real estate without permission, if necessary, is invalid.

But if in cases where the foreigner has resided in Poland for at least 5 years from being granted a long-term EU residence permit or residence permit; or is married to a Polish citizen and the purchased real estate will be jointly owned by the couple; or is a national or entrepreneur of the countries party to the Treaty on the European Economic Area and the countries of the Swiss Confederation - no real estate permit is required.

As regards privileges, the fact of owning a property in Poland does not entitle its owner to a legal stay beyond the prescribed visa period, nor does it entitle him to obtain a temporary or permanent residence permit.

Spain

In Spain, there are quite stringent requirements for the future owner of a foreign real estate. First, it is often mandatory to draw up a preliminary «contrato de arras» sale agreement, which defines an oral agreement on all material terms of a future agreement, such as price, form of payment between the parties, payment schedule and amount of deposit. Second, it is mandatory for the foreign buyer to obtain the «Numero de Identificacion de Extranjero» - the foreigner's identification number, which must be entered in the sales contract. In order to receive this number, a foreigner must apply in advance to local unit of the national police.

After receiving all the necessary permits and documents, a notarization of the real estate purchase contract at the location of the real estate is made, as well as the payment of taxes in the amount of 6-10% of the value of the real estate in the secondary market and 10% in the primary market. It is also necessary to consider the additional costs of notarization, mortgage (if there is a mortgage), clearance of documents, translator and more.

Georgia

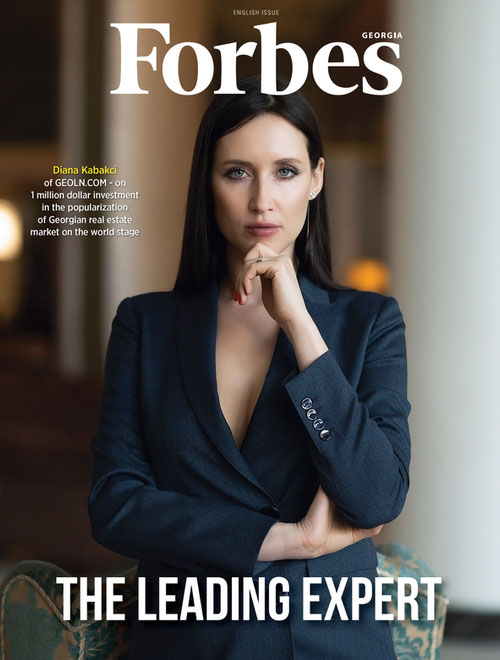

Georgia is in incredible demand today to buy property in the primary market and especially apartments in the world-famous hotel chains on the Black Sea coast or at ski resorts. The advantage of buying real estate in Georgia is the absence of a mandatory declaration of funds that are paid as payment of the contract of sale, the possibility of mortgage lending for foreign citizens with an annual interest of 9%; the absence of a real estate tax and the ability to issue a temporary residence permit in a simplified manner, of course, subject to compliance with other requirements of Georgia law (for example, legal residence in its territory, non-compliance with offenses and valuation of real estate in excess of $ 105,000).

Turkey

Turkey attracts home buyers with a mild climate and variety of offers. However, foreign nationals can become owners of real estate in Turkey with some restrictions. For example, for foreign and natural persons and legal entities, it is forbidden to buy objects in rural areas, forbidden military and security zones, as well as for land plots. To acquire real estate in Turkey, citizens of some countries will need a residence permit. Only an object registered in the state register as a dwelling or a workplace (commercial real estate) can be registered for a foreign citizen.

To enter into a sales agreement, it will be necessary to open an account with a Turkish bank, since the payments between the buyer and the seller are made mainly by bank transfers; tax registration and residence permit (for citizens of some countries). As a rule, the purchase contract itself is drawn up either at the agency or at a notary. The presence of a notary public is recommended by national legal practice. Notary costs are borne by the buyer. Also, when signing agreements with the participation of foreigners who do not speak Turkish, the state translator's signature is a prerequisite for the legitimacy of the agreement. The tax on the purchase of real estate in Turkey is 3% of the amount fixed in the contract and is paid equally by the seller and buyer.

One of the benefits of buying real estate in Turkey is mortgage lending, also allowed for foreign nationals. You can apply for a mortgage in Turkey only for the objects located in cities such as Antalya, Alania, Bodrum, Didim, Kusadasi, Mahmutlar, Mugla, Istanbul, Fethiye. However, in this case, it will be mandatory for the borrower's financial position to assess the solvency and probable financial risks of the bank. Finally, if you became a property owner in Turkey for a value of $ 250,000, you are entitled to a residence permit and then nationality.

Therefore, the procedure for concluding a real estate purchase and sale agreement by foreigners in many countries is not too complicated but requires strict compliance with the applicable national law.